Squaring the circle between valuing labor and adding value to labor is a key to unlocking pent-up potential in business and fostering business growth. But perhaps it needn’t be such a dilemma as a combination of strategy and HCM systems may just hold the answer.

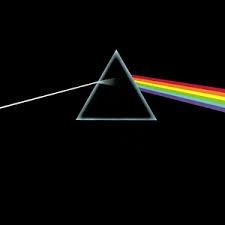

Sometimes, from obscure conversations, nuggets of wisdom are born. And so it was during a working dinner in Boston on Tuesday night, that the conversation moved to albums, and the inevitable discussion of  Pink Floyd’s “Dark Side of the Moon,” a favorite of mine for sure (although I prefer the slightly more rugged “Animals” album). But the conversation followed a brief foray into human capital management (HCM) and tech solutions that allowed for the two, at least in my mind, to merge into reflection in the cab on the way back to the hotel.

Pink Floyd’s “Dark Side of the Moon,” a favorite of mine for sure (although I prefer the slightly more rugged “Animals” album). But the conversation followed a brief foray into human capital management (HCM) and tech solutions that allowed for the two, at least in my mind, to merge into reflection in the cab on the way back to the hotel.

The mix of labor valuation and skills investment was playing out in my mind to a backdrop of ‘time’ and ‘money’. The conundrum I was grappling with was that in order to add value to labor, you must invest in developing it. But in order to invest (responsibly), you need the return on investment (RoI), and without a reliable valuation method, how can you establish the RoI to inform the investment decision required to add value?

It is even more of an issue if you consider that 87% of a company’s value is derived from its intangible base, a large part of which is driven by the consolidated value of labor and its potential for a company.

So the challenge was to consider the best way to provide labor valuation to enable development investment, thereby increasing the value of the business.

This can be achieved by considering three aspects:

- Strategy – This provides the direction of what is to be developed and why.

- Development methods – There are many deployment methods for closing skills gaps.

- Time valuation – There are three main methods for valuing output. One for each recipient.

Strategy purpose

A good strategy provides a destination, direction and development. The development aspect is the closure of skills gaps needing to be filled in order to carry out the directions to reach the destination. This ensures that development is for a defined and agreed purpose, and the gap closure can be costed based on the methods used.

Development methods

With the development areas known, linked to the attainment of corporate goals, the methods of development can be chosen from training, recruiting, contracting, partnering or outsourcing. Each of these methods can be considered and accurately costed with action plans in place to make them happen.

Time valuation

The currency of labor is time (input), but the value of labor is services (output) and the correlation between the cost of input and the value of output is at best, highly complex. Output value ebbs and flows depending on the type of labor, the activities performed, the commercial construct and a myriad of other variables. There is also the requirement to consider three different valuation outcomes: paid value (to the employee), costed value (to the employer) and generated value (to the business).

HCM systems can help in this regard, providing the correlation between the employment contract, commercial contracts (projects/work orders) and cost centers, with a connection to the various rates and allowances, which calculate the value outcomes to the employee and employer. This provides positive values for the paid value and costed value, but the generated value remains elusive.

It is the intangible nature of the generated value of labor which requires a ‘dabble’ with the dark side, and is only really evident, in total, by deducting the known tangible value of a business from its market value and assigning a relevant proportion to labor from other intangibles.

How to invest in adding value

With costed development options, costed labor and calculated paid and costed values, we can easily assign a RoI and know that this investment is necessary to successfully execute business strategy. This should be enough to enable investment, depending on the hurdle rate, but it does fall short of a full assessment of value until the intangible benefits have been calculated and assigned, which is a financial dark art.

As complex as it is to explain, full development investment can be derived, it just needs an understanding of the dark side of intangible valuation. But of course when it comes to intangibles, “there is no dark side, as a matter of fact, it’s all dark.”

I welcome comments on this or any other topic concerning finance, HCM, CSR and business strategy.

Connect, discuss, and explore using any of the following means:

- Twitter: @stevetreagust

- IFS website: www.ifsworld.com

- Email: steve.treagust@ifsworld.com

- Blog: http://blog.ifs.com/author/steve-treagust

- LinkedIn: https://www.linkedin.com/in/stevetreagust

衣皇后

学习使人进步,到此拜读!

Steve Treagust

I think progress will come if we can transfer this value to the Balance Sheet and see it’s value in a more traditional sense.

衣皇后

从百度进来的,博客不错哦!